For Professionals, By Professionals

Discover ProX PC for best custom-built PCs, powerful workstations, and GPU servers in India. Perfect for creators, professionals, and businesses. Shop now!

SERVICES

WE ACCEPT

Contents

The integration of Artificial Intelligence (AI) technologies within the finance industry has fully transitioned from experimental to indispensable. Initially, AI’s role in finance was limited to basic computational tasks. With advancements in machine learning (ML) and deep learning (DL), AI has begun to significantly influence financial operations.

Arguably, one of the most pivotal breakthroughs is the application of Convolutional Neural Networks (CNNs) to financial processes. This drastically enhanced the capabilities of computer vision systems to recognize patterns far beyond the capability of humans.

In this article, we present 7 key applications of computer vision in finance:

About us: ProX PC allows companies to manage the entire ML lifecycle in a single, easy-to-use interface. By controlling the entire lifecycle, ML teams no longer need to rely on point solutions to fill in the gaps. To learn more about ProX PC, book a demo with our team.

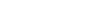

Models like YOLO (You Only Look Once) models and Faster R-CNN have set benchmarks in real-time processing as well. Near-instantaneous speeds are crucial for fraud detection and high-frequency trading.

Object-level image annotation with YOLOv8

Simultaneously, technologies like TensorFlow and PyTorch have become cornerstones of developing and deploying complex modes. This is largely thanks to their ability to analyze vast arrays of financial data from market trends to customer behavior.

Privacy-preserving Computer Vision with TensorFlow Lite

Other significant contributions include works by Andrew Ng. This computer scientist and technology entrepreneur has extensively researched AI and machine learning’s impact on finance. He continues to play a leading role in showcasing models that can predict market changes with unprecedented accuracy.

Furthermore, the introduction of GANs (Generative Adversarial Networks) has accelerated AI adoption. These serve as the ideal framework for sophisticated simulations of financial scenarios for risk assessment and decision-making.

These technological breakthroughs are continuing to transform how financial institutions operate. By offering unprecedented speeds and scalability to derive insights and patterns from data, they are fast becoming indispensable. Below, we’ll explore some of the successful outcomes of how these AI tools for finance are revolutionizing the industry.

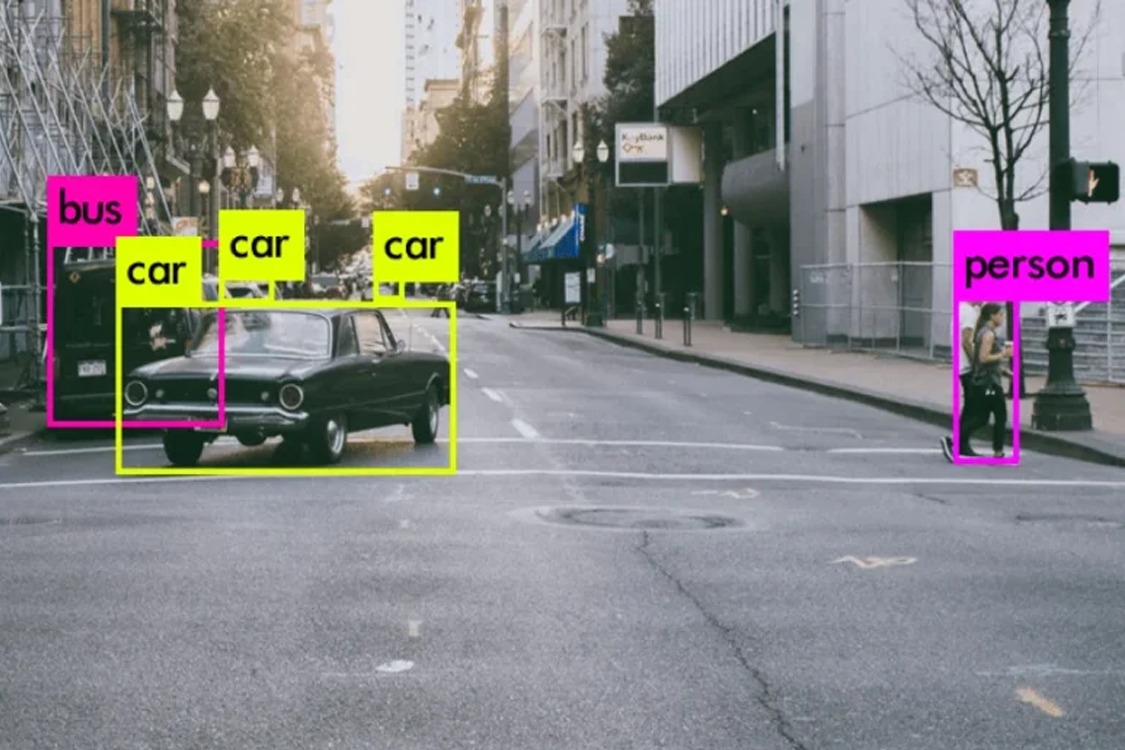

AI-powered fraud detection systems use machine learning algorithms to detect patterns and anomalies that may indicate fraud. These systems process vast datasets in real-time, identifying irregularities in transactions and user behaviors.

Institutions widely use machine learning models like Random Forest, neural networks, and anomaly detection algorithms. TensorFlow and PyTorch are among the most popular frameworks for developing and deploying these solutions.

As an example, PayPal uses deep learning to analyze a wide array of data to spot fraudulent transactions more accurately. Another notable case study is Mastercard’s deployment of Decision Intelligence, a comprehensive fraud detection tool. It leverages AI to assess the transaction context and customer’s profile to gauge the risk of fraud. Its initial modeling shows an increased detection rate of 20% and up to 300% in some cases.

Traditional Methods of Fraud Detection Vs. Computer Vision Technique for Fraud Detection

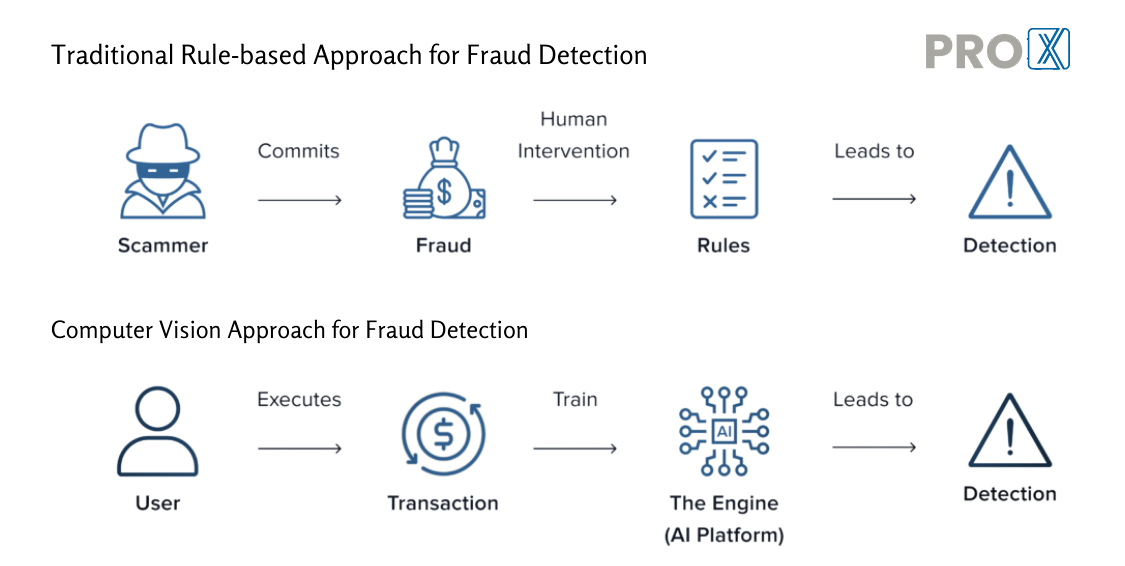

Computer vision can automate the extraction, analysis, and validation of document information. This has the potential to revolutionize many processes by accelerating processing times while improving accuracy and security.

Real-world applications range from automating loan approvals to processing insurance claims. Technologies such as Optical Character Recognition (OCR) and Natural Language Processing (NLP) are foundational to this.

Google Cloud Vision API and Tesseract are prominent OCR tools for converting images of text into machine-readable data. On the other hand, NLP frameworks like BERT help in understanding the context and content of documents.

Workflow diagram illustrating the integration of Google Cloud Vision and Natural Language APIs for streamlined document analysis and processing in cloud storage.

JPMorgan Chase's COIN platform is one example of this approach in action. It uses machine learning to review and interpret commercial loan agreements. It's reportedly responsible for reducing document review time from 360,000 hours to seconds. This efficiency not only brings down operational costs but also enhances decision-making and customer experiences.

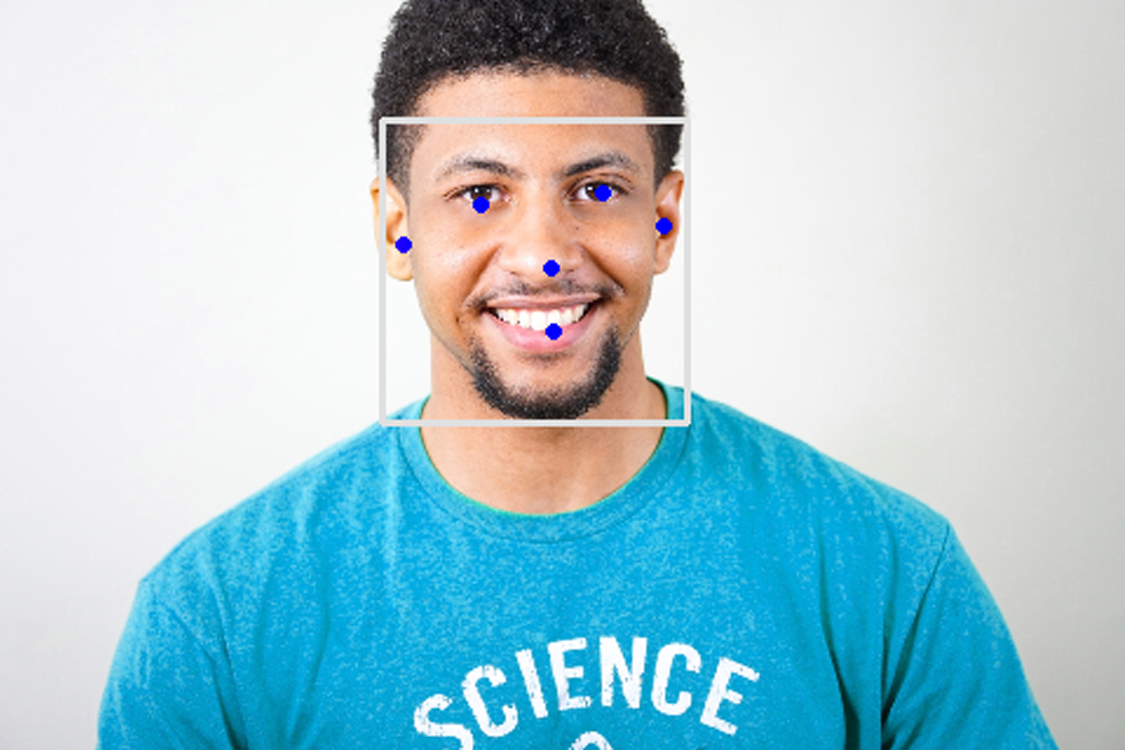

Biometric security has become a cornerstone in the finance industry, offering a robust mechanism for secure customer identification. Financial institutions now routinely deploy fingerprint scanning, facial recognition, and voice identification to provide secure and convenient user access.

Use cases span from mobile and online banking apps using fingerprints and facial recognition to ATMs with voice verification. These systems rely on Al models, like CNNs, for image recognition and recurrent neural networks (RNNs) for voice pattern analysis. In turn, these models are typically developed using frameworks like TensorFlow and Keras.

An illustrative case study is HSBC's use of voice recognition to verify customer identities. Voice ID drastically reduces the time spent on customer authentication, often a frustrating part of the telephone support experience. Similarly, Wells Fargo and many other banks use multiple modalities for biometric authentication on their mobile apps.

![]()

Tracking facial biometrics with computer vision on ProX PC

Computer vision's role in financial markets includes visual data analysis and interpretation. It enables traders to assimilate and act upon complex market indicators swiftly. Using deep learning models, such as Long Short-Term Memory (LSTM) networks, firms analyze time-series data for predictive insights. This makes algorithmic trading strategies that can adapt to market dynamics in real-time possible.

These systems leverage frameworks like Keras and PyTorch for their ability to handle sequential data to understand market trends. Al's benefits extend to processing unstructured data from news feeds and social media. For example, combining computer vision for sentiment analysis during financial events with NLP to gauge market sentiment and inform trading decisions.

Face detection for sentiment analysis with computer vision

Al's predictive analysis capabilities are redefining credit scoring as well. Machine learni can analyze credit risk by using vast amounts of data, even from non-traditional source These algorithms can predict loan defaults more accurately, aiding lenders in making more data-driven credit decisions.

Computer vision can extract and analyze data from documents that traditional system. might overlook. It uses neural networks and decision trees for a comprehensive approach to risk evaluation.

ZestFinance's Zest Automated Machine Learning (ZAML) platform is a cutting-edge credit risk management technology. It enables more precise risk assessments by analyzing thousands of data points. Ant Financial takes a similar approach to its Sesar Credit scoring system. It combines transaction data with public records to assess creditworthiness in the absence of traditional credit histories.

Reports by the Federal Reserve have shown that machine-learning models can significantly outperform traditional credit scoring methods. These advancements allow for not only faster but also more equitable credit decisions, expanding market access t previously underserved populations.

Al has become a vital tool for ensuring regulatory compliance in the finance sector. Its ability to monitor transactions for signs of money laundering, insider trading, and other illicit activities is indispensable. Machine learning models, like Support Vector Machines (SVMs) and Neural Networks, can detect patterns and anomalies in vast datasets. Their accuracy and scalability make them capable of detections that human auditors are likely to miss.

In transaction surveillance, computer vision systems can monitor and analyze complex trading patterns and visual data. They can then flag unusual activities for further review by human auditors. These systems often rely on anomaly detection algorithms implemented using frameworks like TensorFlow and Apache Kafka.

Surveillance with Action Localization

Technologies like anomaly detection algorithms, implemented via platforms such as TensorFlow and Apache Kafka, are key to these surveillance systems.

Danske Bank’s adoption of anti-money laundering (AML) to combat financial crime is one example. They implemented an AI platform that screens transactions and customer behavior according to their compliance framework. This has markedly improved Danske Bank’s ability to detect potential compliance breaches and take preemptive action.

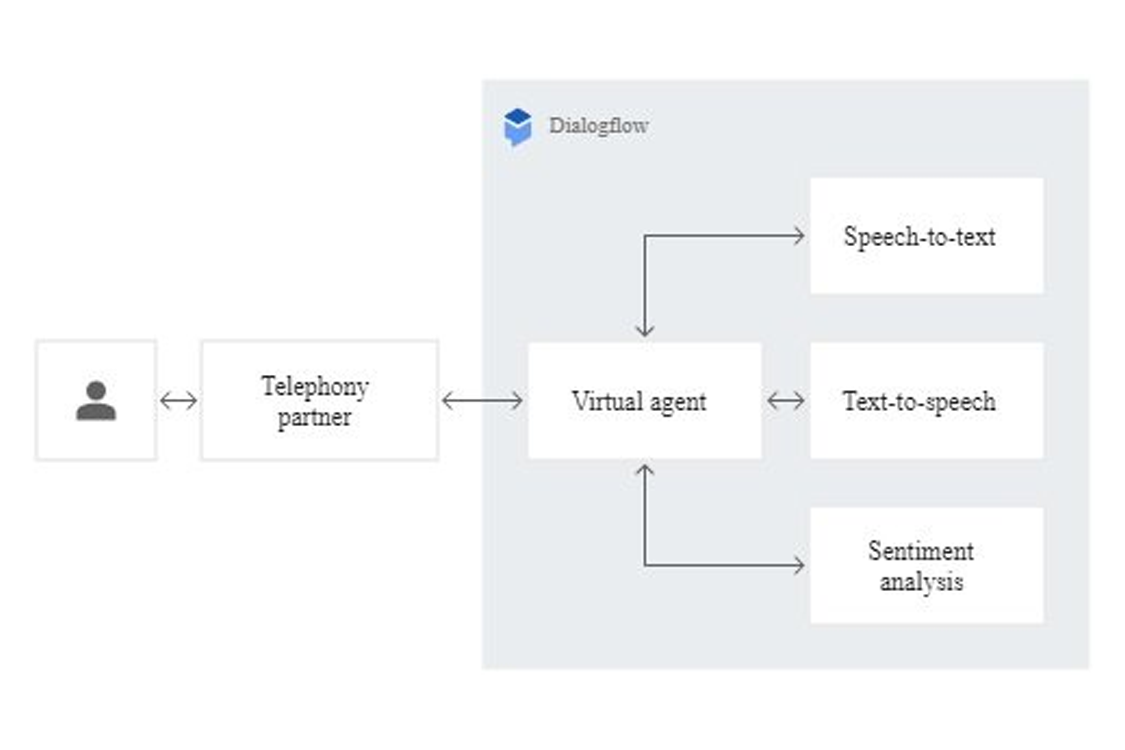

AI chatbots and virtual assistants in finance may significantly enhance user experiences by providing quick, personalized, and efficient responses. These AI tools use NLP and ML techniques to engage with customers, answer queries, and even provide financial advice.

For instance, Bank of America’s chatbot, Erica, employs predictive analytics and cognitive messaging to deliver financial guidance to customers. Erica can assist with simple transactions, provide credit report updates, and offer proactive suggestions for personal finance management. It has already surpassed 1.5 billion customer interactions and should only improve with time.

Another example is Capital One’s virtual assistant, Eno. This AI assistant can answer questions, spot fraud, track spending, and manage cards and accounts. Both of these systems utilize a chat-like conversational interface to handle all of these consumer interactions.

Many of these AI-powered tools utilize frameworks like Google’s Dialogflow or IBM Watson. These systems help scale meaningful customer interactions with lower waiting times while reducing ticket loads.

A schematic representation of how Dialogflow integrates with telephony systems to facilitate natural language conversations, employing speech recognition, sentiment analysis, and text-to-speech technologies.

The frontier of financial AI is largely propelled by predictive analytics. This technology is becoming increasingly indispensable for improving decision-making and future-proofing financial strategies. New paradigms, like Reinforcement Learning and Quantum Computing, will further enhance and refine predictive models.

Some emerging technologies and potential applications to watch out for include:

Federated learning for privacy-preserving data analysis.

Goldman Sachs, for example, is already exploring quantum computing to speed up various time-consuming financial operations. We are also already witnessing the rise of AI-driven hedge funds like Renaissance Technologies. These firms use advanced mathematical models to exploit existing market inefficiencies.

However, the implementation of computer vision and AI in the financial services industry is not without its challenges. Some of the significant obstacles that future AI tools for finance will need to overcome are:

We are seeing some existing frameworks address some of these issues, like TensorFlow Quantum and IBM’s Watson OpenScale. They address these challenges by providing the groundwork for transparent and ethical AI applications in finance.

For more info visit www.proxpc.com

Related Products

Share this: